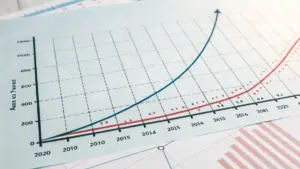

Effective capital management is essential for the sustainable growth of any startup. It involves carefully tracking and managing financial resources to ensure that the startup has the necessary funds to operate efficiently and meet its financial obligations. This includes budgeting, forecasting, and financial reporting. A well-defined budget is crucial for effective capital management. It outlines the expected expenses and revenue streams for a specific period. This allows startups to track their spending and ensure that they are staying within their allocated budget. A well-defined budget is essential for financial stability. Regular financial reporting is essential for monitoring the financial health of a startup. It provides insights into the company’s performance and allows for timely adjustments to strategies. This includes analyzing key financial metrics, such as revenue, expenses, and profitability. Regular financial reporting is essential for informed decision-making.

Venture Investment Planning: A Step-by-Step Approach

Venture investment planning is a crucial process for startups seeking funding.