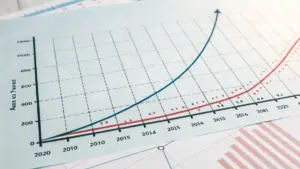

Venture investment planning is a crucial process for startups seeking funding. It involves developing a comprehensive plan that outlines the startup’s financial needs, investment strategy, and exit strategy. This plan serves as a roadmap for securing funding and achieving long-term goals. A detailed financial projection is a key component of venture investment planning. It outlines the startup’s expected revenue, expenses, and profitability over a specific period. This projection helps potential investors assess the startup’s financial viability and potential for return on investment. Developing a robust exit strategy is essential for venture investment planning. It outlines the potential ways in which the startup can generate a return on investment for its investors. This could include an acquisition, an IPO, or a strategic partnership. A well-defined exit strategy is essential for attracting investors.

Venture Investment Planning: A Step-by-Step Approach

Venture investment planning is a crucial process for startups seeking funding.