Early-stage investment plays a pivotal role in the success of any startup. It provides the necessary capital to fuel growth, develop innovative products, and expand market reach. This initial funding often comes from a variety of sources, including angel investors, venture capitalists, and crowdfunding platforms. Careful consideration of these options is essential for startups. Thorough due diligence is paramount when evaluating potential investors. Startups must carefully assess the investor’s track record, investment strategy, and alignment with the startup’s vision. Understanding the investor’s network and potential synergies can significantly impact the startup’s future. Furthermore, startups should be prepared to negotiate terms and conditions that are mutually beneficial. The process of securing early-stage investment often involves a series of meetings, presentations, and negotiations. Startups must effectively communicate their business model, market analysis, and financial projections to potential investors. Building strong relationships with investors is crucial for long-term success. A well-structured pitch deck is essential for conveying the startup’s value proposition effectively.

Venture Investment Planning: A Step-by-Step Approach

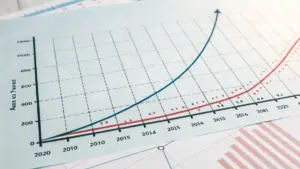

Venture investment planning is a crucial process for startups seeking funding.